Investing in Vallourec is supporting a profoundly transformed company, , with a strategy focused on value creation and operational excellence that continues to bear fruit.

2025 dividend of €1.50

objective of redistributing 80-100%

of total cash generation

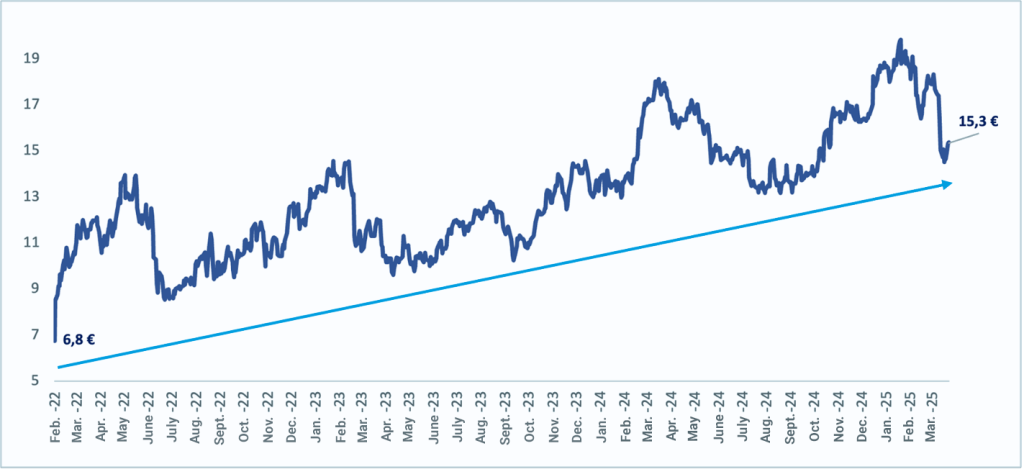

Share price increase of +125%

(02.27.2022 to 04.15.2025)

Dividend yield of c.10%

one of the highest in the SBF 120

(as of 04.15.2025)

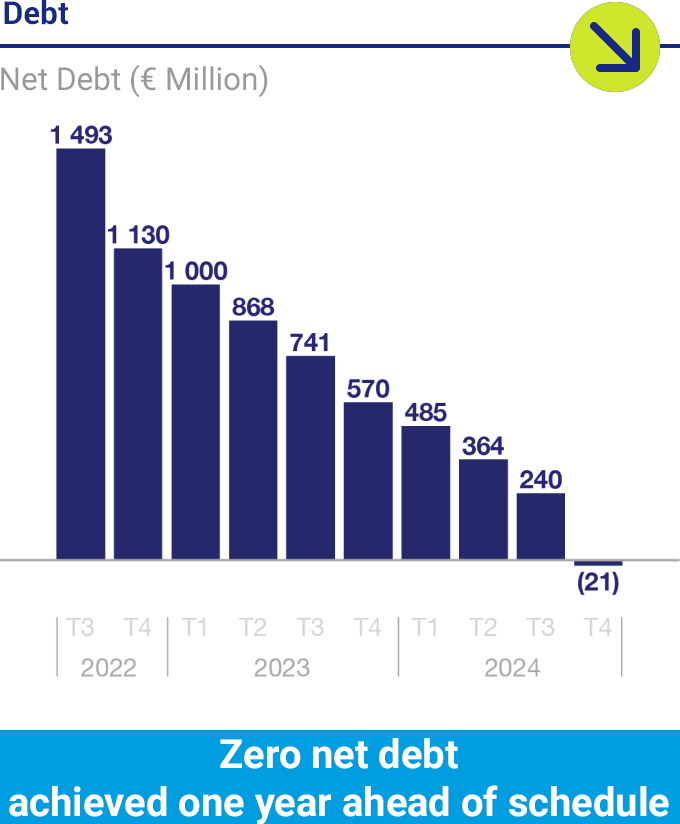

Having fully achieved its debt reduction objective (zero net debt), Vallourec enters a new phase in its development, marked by a capital allocation policy that places shareholders at the heart of its priorities.

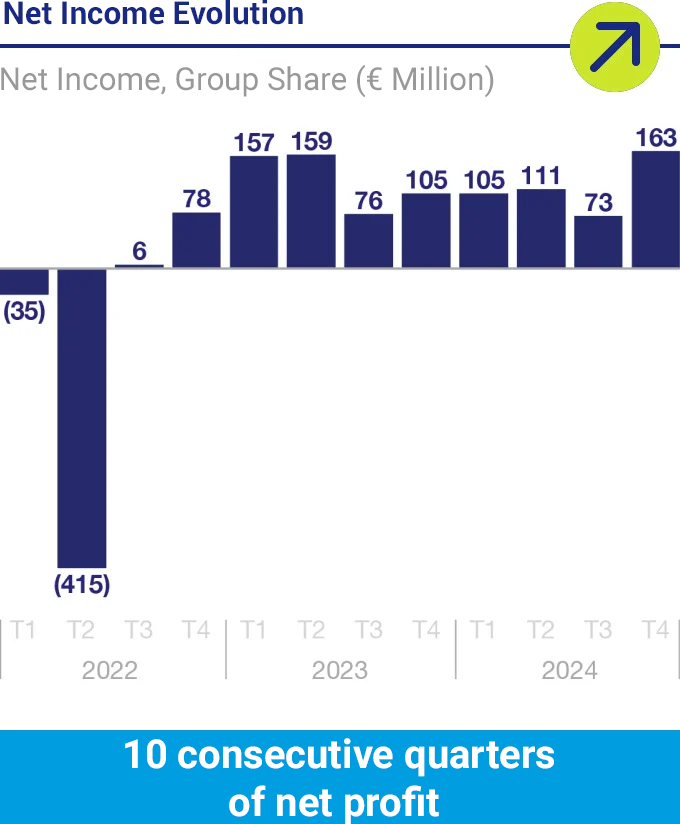

The return of the dividend announced for the 2024 financial year and proposed to the 2025 Annual General Meeting marks the first return to shareholders in ten years and lays the foundations for future recurring returns.

A trusted partner covering 4 areas of expertise

Vallourec provides a comprehensive range of premium seamless tubes, specialty tubes, and innovative solutions to meet the most demanding client needs in the Oil & Gas and New Energies sectors (including hydrogen, geothermal, and carbon capture and storage).

The Group’s commitment to reliability and cost effectiveness makes it the preferred choice for clients tackling complex applications and extreme conditions.

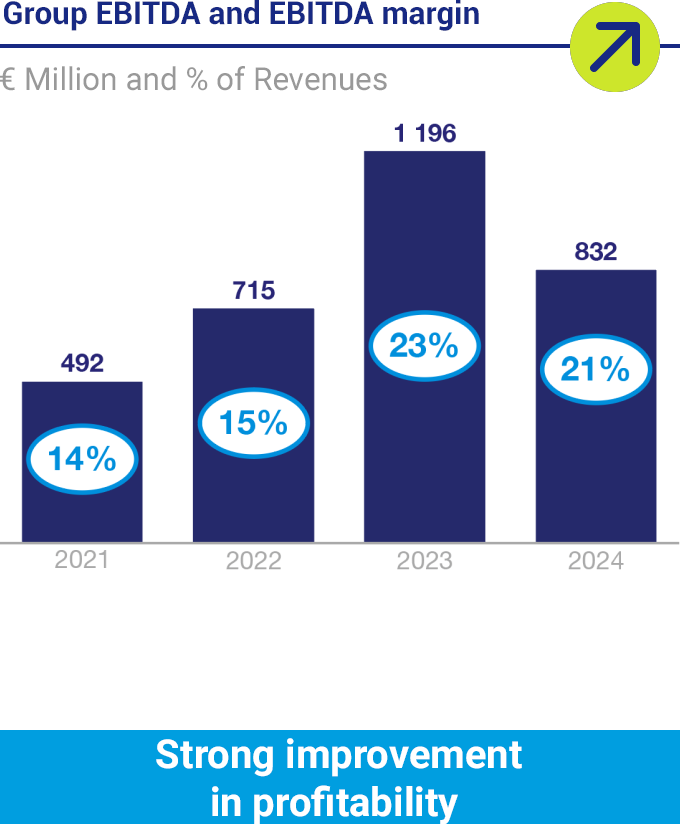

Announced in 2022, the New Vallourec plan aimed to create a company that will remain profitable and sustainable, regardless of market conditions. The roadmap was clear: deliver best-in-class profitability, reduce the profitability gap with the sector’s leading players and make Vallourec resistant to market fluctuations.

Two major operational initiatives were key to achieving these goals:

1. Realigning the Group’s industrial footprint around three geographies – North America, South America, and Eastern Hemisphere – and thus be closer to our key markets.

2. Targeting value over volume, focusing on premium markets and exiting all commodity markets.

Our significant progress in reshaping Vallourec has been recognized by the three main rating agencies: S&P (BB+; Positive Outlook), Moody’s (Ba2; Positive Outlook) and Fitch, which has rewarded our efforts by positioning Vallourec in the Investment Grade category (BBB-; Stable Outlook).